Swiggy's Ambitious IPO Strategy: What Sets It Apart from Rivals Like Zomato

Swiggy's anticipated IPO is generating significant buzz, with analysts keenly observing its unique approach compared to competitors like Zomato. This article dives into Swiggy’s strategy, its points of differentiation, and the strengths it brings to the table as it prepares to go public.

Swiggy's Major IPO Announcement: Key Factors That Distinguish It from Zomato

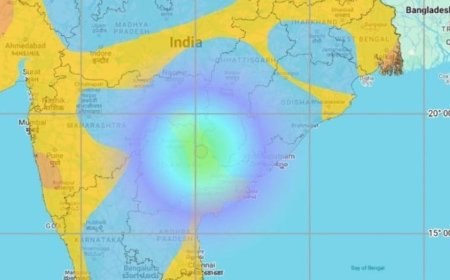

Swiggy is preparing for a major initial public offering (IPO), drawing significant attention in the food delivery and tech sectors. As one of India’s leading food delivery platforms, Swiggy is entering the stock market with strategies that differentiate it from its closest competitor, Zomato. Below is an in-depth look at the defining aspects of Swiggy’s IPO plan and what sets it apart in a fiercely competitive landscape.

1. Swiggy’s IPO: A Closer Look at Its Objectives

- Swiggy's IPO is seen as a strategic step to raise capital, expand its services, and enhance its competitive stance.

- The funds raised will be used to strengthen Swiggy’s market position, focusing on technology, logistics, and service expansion.

- This IPO is Swiggy’s opportunity to gain investor trust by showcasing its unique growth trajectory compared to Zomato and other players.

2. Market Timing and Investor Sentiment

- Swiggy has chosen a market moment that is witnessing renewed investor interest in tech-based service companies, including food delivery.

- The IPO timing aligns with Swiggy's increasing popularity, post-pandemic growth, and its push to capture a greater share of the food and grocery delivery market.

- By capitalizing on current market conditions, Swiggy aims to attract investors who see potential in India’s growing online food service industry.

3. Unique Value Proposition Compared to Zomato

- Swiggy’s business model encompasses both food and grocery delivery, with Swiggy Instamart playing a pivotal role in its revenue diversification.

- Unlike Zomato, which primarily focuses on restaurant delivery, Swiggy’s multi-service platform is designed to capture a broader customer base.

- This diversification could be a selling point for investors looking for stability and multiple revenue channels in a single investment.

4. Strengthening Swiggy Instamart’s Position

- Swiggy’s entry into the grocery delivery sector through Instamart marks a significant expansion of its service offerings.

- With a dedicated focus on quick commerce, Instamart adds resilience to Swiggy’s portfolio, appealing to urban users seeking convenience.

- By offering more than just food delivery, Swiggy differentiates itself from competitors and aims to attract both daily and occasional users.

5. Technological Innovations Leading to Operational Efficiency

- Swiggy has invested in AI-driven logistics to optimize delivery time, route mapping, and resource allocation.

- Its technological approach aims to improve customer experience by reducing delivery times and maintaining consistency in service quality.

- Such innovations not only enhance operational efficiency but also serve as a competitive advantage, appealing to tech-savvy investors.

6. Focus on Expanding to Tier 2 and Tier 3 Cities

- With increased penetration into Tier 2 and Tier 3 cities, Swiggy is tapping into new demographics and growing its customer base.

- This expansion offers Swiggy a unique growth edge, as Zomato has not yet focused as strongly on these regions.

- A wider customer reach in smaller cities provides potential for higher revenue and a more diversified user base.

7. Improving Delivery Partner Experience and Retention

- Swiggy’s approach to ensuring fair wages and improved work conditions for delivery partners could enhance retention and reduce operational disruptions.

- This focus on the workforce resonates with socially conscious investors and sets Swiggy apart as a company prioritizing sustainable practices.

- A content and stable workforce could contribute to Swiggy’s brand reputation, which can influence customer loyalty and positive investor sentiment.

8. Financial Resilience and Focus on Profitability

- Swiggy has implemented cost-control measures and is working on a steady path towards profitability, a key metric for IPO success.

- Unlike some competitors, Swiggy’s balance of cost management and growth investments demonstrates financial discipline.

- Investors are likely to find Swiggy’s financial transparency and efficiency attractive as it prepares to list publicly.

9. Swiggy’s Approach to Strategic Partnerships and Alliances

- Partnerships with local brands, cloud kitchens, and e-commerce platforms broaden Swiggy’s service offerings and boost brand recognition.

- Strategic alliances have also helped Swiggy strengthen its logistics and fulfillment capabilities, giving it a logistical advantage over competitors.

- Collaborative efforts with brands and tech firms ensure Swiggy remains relevant and competitive in the fast-evolving delivery market.

10. Potential Investor Benefits and Risks to Consider

- Benefits: Swiggy’s diversified service offerings, technological advances, and robust expansion strategy make it an appealing choice for investors looking for a solid player in India’s food delivery sector.

- Risks: Potential competition from new entrants, economic challenges, and regulatory changes are factors that investors may need to consider.

- Swiggy’s performance post-IPO will depend on its ability to navigate these risks while maintaining a steady growth rate and market relevance.

11. How Swiggy’s IPO May Impact the Food Delivery Industry

- Swiggy’s IPO is expected to set new benchmarks for companies in the online food and quick commerce sectors.

- Its IPO success could encourage more tech companies in India to consider going public, influencing market dynamics.

- A successful public listing for Swiggy may lead to increased competition, innovation, and better services within the industry.

Swiggy’s IPO is not just about raising funds but about establishing its position in a highly competitive field. With unique offerings, strong technology backing, and a diversified portfolio, Swiggy is setting itself up as a formidable player in the public market. By capitalizing on its strengths and differentiating itself from Zomato, Swiggy’s IPO is poised to make waves in the stock market and reshape India’s food delivery sector.

What's Your Reaction?