"Minister Dinesh Gundu Rao Highlights Karnataka’s Unequal Share in Tax Allocation"

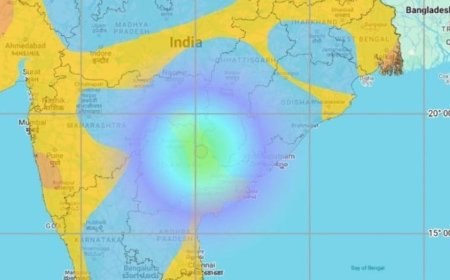

Minister Dinesh Gundu Rao recently voiced concerns over Karnataka’s insufficient share in national tax distribution, stating that the state is not receiving a fair allocation based on its contributions. This article examines the reasons behind Karnataka’s claims, explores how it impacts the state’s financial health, and looks at the broader implications for state-level growth and development.

What's Your Reaction?