"Afcons Infra Stock Surges by 13% After Initial Drop, Emerges as Lowest Bidder for ₹1,007 Crore Project"

Afcons Infrastructure Ltd. saw a 13% recovery in share value following an initial drop after its market debut. The company’s stock surged as it was announced as the lowest bidder for a major project valued at ₹1,007 crore, boosting investor confidence and market performance. This article provides a detailed overview of the share performance, project bidding, and what it means for Afcons Infra’s future.

Afcons Infra Shares Rise by 13% After Decline: Secures Position as Lowest Bidder for ₹1,007 Crore Project

Afcons Infrastructure Ltd. experienced a promising rebound in its stock performance, marking a 13% increase after its shares initially opened lower. The surge in share value came as the company emerged as the lowest bidder for a high-value infrastructure project worth ₹1,007 crore. Here’s a breakdown of the factors driving this stock recovery, investor reactions, and the potential outlook for Afcons Infra in the competitive infrastructure sector.

1. Initial Stock Listing and Market Debut Challenges

- Opening in the Red: Afcons Infra’s shares began trading lower than expected on the day of its listing, creating initial investor apprehension.

- Market Reaction: This opening drop led some investors to adopt a cautious approach, with market analysts closely observing the company's performance and future project announcements.

- Early Setbacks: Initial volatility in the stock price highlighted concerns around sector stability, prompting Afcons to secure investor confidence through strategic project wins.

2. Recovery Boosted by Project Bid Announcement

- Winning the Lowest Bid: Afcons Infra announced its position as the lowest bidder for an infrastructure project valued at ₹1,007 crore, which significantly influenced its share price.

- Positive Market Sentiment: This news instilled optimism among investors, pushing Afcons’ stock up by 13% from its initial listing price.

- Project Significance: The project’s high valuation underscores Afcons’ ability to compete in large-scale infrastructure contracts, which bodes well for its long-term market presence.

3. Factors Driving Share Price Surge

- Strategic Project Acquisition: The company’s aggressive approach in acquiring major projects has been instrumental in reinforcing investor trust, reflected in the share rebound.

- Confidence in Growth Potential: Afcons’ ability to secure the lowest bid in a competitive field boosts perceptions of its potential for sustained revenue growth.

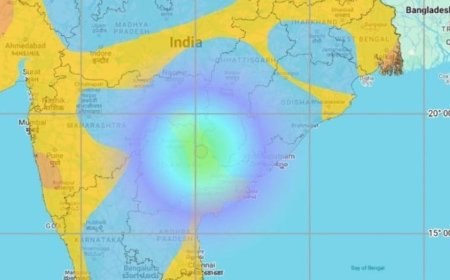

- Sector-Wide Implications: As infrastructure remains a key sector in India’s growth story, companies like Afcons are strategically positioned to benefit from future opportunities.

4. Insights into the ₹1,007 Crore Project

- Project Scale and Impact: This project, valued at ₹1,007 crore, involves complex infrastructure development, demonstrating Afcons’ capability in handling large projects.

- Timeline and Expectations: The project is expected to kick off soon, with Afcons anticipating a steady revenue stream upon its commencement.

- Market Impact: Winning such high-value contracts positions Afcons as a leading competitor within the infrastructure industry, providing the company with a strategic edge.

5. Investor Reactions and Market Sentiment

- Positive Market Reception: Following the project bid news, investors responded favorably, leading to a notable uptick in Afcons Infra’s share price.

- Renewed Optimism: Market confidence was restored as investors recognized Afcons’ capability in securing valuable contracts amidst competitive bidding.

- Long-Term Prospects: For many investors, Afcons’ latest win signals the company’s strong prospects within India’s expanding infrastructure sector, increasing interest in its stock.

6. Afcons Infra’s Competitive Edge in the Infrastructure Sector

- Expertise in Large Projects: Afcons has built a solid reputation for managing complex infrastructure projects, giving it an advantage in bidding for high-value contracts.

- Cost-Effectiveness: As the lowest bidder, Afcons demonstrates a strong understanding of cost management, which appeals to both clients and investors.

- Diverse Project Portfolio: With a wide range of projects in its portfolio, Afcons showcases versatility that enables it to adapt to different client requirements and market demands.

7. Potential Challenges and Risks

- Market Competition: Afcons faces stiff competition from other infrastructure firms vying for similar contracts, which could impact future project bids.

- Economic Fluctuations: Changes in the economy, such as inflation or supply chain disruptions, could affect project costs and timelines, potentially impacting Afcons’ profitability.

- Project Execution Risks: Large-scale projects come with inherent risks in terms of deadlines, resource management, and cost overruns that Afcons must manage efficiently.

8. Long-Term Outlook and Growth Potential

- Positive Growth Trajectory: The recent contract win sets the stage for sustained growth, with Afcons expected to continue bidding for similar projects.

- Sector Expansion: India’s infrastructure sector is projected to expand significantly, providing ample opportunities for Afcons to secure additional projects.

- Enhanced Shareholder Value: With a series of successful project bids, Afcons is well-positioned to boost shareholder value over the long term, maintaining investor interest.

9. Strategic Plans and Future Prospects

- Focus on Major Contracts: Afcons plans to prioritize high-value projects, ensuring steady revenue growth and sector presence.

- Sustainable Practices: In alignment with industry trends, Afcons aims to incorporate sustainable practices in its projects, which could enhance its brand image and appeal.

- Investment in Technology: To improve efficiency and project outcomes, Afcons is likely to invest in advanced technology, supporting its competitive edge.

10. Implications for Infrastructure Sector Investors

- Increased Confidence: The successful bid showcases Afcons’ potential, building investor confidence in its stock.

- Attractive Investment Opportunity: As Afcons continues to win significant projects, its stock could become an attractive choice for investors focused on infrastructure.

- Sector Growth Prospects: The Indian government’s focus on infrastructure development makes the sector highly promising, with companies like Afcons at the forefront.

Final Thoughts on Afcons Infra’s Stock Rebound and Project Bid Success

The rebound in Afcons Infra’s stock following an initial dip highlights the impact of its successful bid for the ₹1,007 crore project, demonstrating investor confidence in the company’s long-term potential. As a prominent player in India’s infrastructure sector, Afcons’ ability to secure major contracts strengthens its position and signals future growth prospects. With an expanding project portfolio, strategic cost management, and a competitive edge, Afcons Infra is set to attract continued investor interest as it pursues further opportunities in this dynamic sector.

What's Your Reaction?